The duty discount really accommodates an incredible chance to swing for the ROI fences each and every year, regardless of your age or total assets. Considering that the typical duty discount is just around $3,000, many individuals simply blow it on material things like shoes, apparel, contraptions, and LED TVs.

It’s not really an ill-conceived notion to utilize your “reward” cash to purchase something substantial: any of these things can give strong utility until the following year’s discount. On the other hand, going the customary course of settling obligation or expanding an exhausted rainy day account is likewise fine, just appallingly unexciting.

Presently assuming your duty discount was an astounding $100,000, I’m willing to bet that your way to deal with spending it would be considered unique!

Some would imprudently go out and spend the cash immediately on an extravagance auto. Most, in any case, would presumably give significantly more thought to the topic of how to send such a huge total.

In any case, the vast majority won’t ever get such a huge discount, so the fact is disputable (sorry!). The $100k discount just gives a psychological activity that features how our ways of managing money shift while managing various degrees of cash.

Albeit a duty discount frequently feels like a decent bonus every year, it’s really been your cash from the start. Furthermore, it is so exhausting to simply put away that cash (now that you, at last, have it) in the securities exchange for an expected 8% authentic return.

Obviously assuming you have a rotating Mastercard obligation with loan fees in the teenagers or higher, unquestionably give that a whack. In any case, as a Financial Samurai peruser, I’m thinking you all are savvier than this.

A 10X Return On Your Money By Investing Your Tax Refund

If it’s not too much trouble, invest some energy perusing, “Retribution Spending: A Way To Get Back At Life” Each of the manners which I recommend gives a return going from 1,000% to precious, as I would see it.

While you presumably can stand to face greater challenges with $3,000, my ideas for money management your duty discount most likely have the least gamble of all — and certainly the greatest result!

Utilize your discount to fabricate better connections at work and at home. Assuming work is working out positively and your affection life is growing, all the other things simply deal with themselves. The present chatter about forcefully putting your investment funds into stocks and securities for a safer monetary future is simply sauce since you’re living in a great second.

Most Effective Way To Spend Your Tax Refund

When was the last time you took your manager out for lunch (on you)? I bet for some individuals, the response is “never”. In any case, as I’ve featured before in, “How To Get Ahead In Your Career” that is actually the thing the absolute most sharp individuals in any association do.

On the off chance that you could clear your way to advancement and a raise, the profit from an extravagant $100 lunch or various snacks with your supervisor is presumably nearer to 10,000% rather than simply 1,000%.

The most joyful minutes in my day-to-day existence are the point at which I’m encircled by family, companions, and friends and family. Recollect those family occasions social affairs, or those extraordinary experience get-aways with your accomplice. What an impact!

What about those pivotal events when your folks gladly watched you move on from the secondary everyday schedule? These are minutes I will always remember. It’s interested the way that we float separated as we progress in years; life disrupts everything, I presume. Burning through cash to be with loved ones can’t be bested.

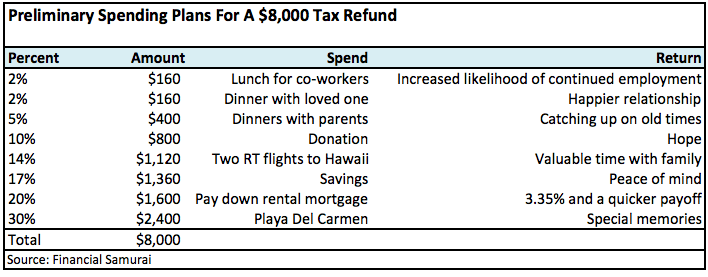

Charge Refund Investing And Spending Plan

My discount this year is somewhat huge on account of conceded pay that is paid in a single amount once per year while done having a bump some severance installment. The IRS thinks the single amount will happen consistently, and along these lines charges the sum at the top expense section. Actually, I procured significantly less to the place where AMT several thousand bucks. One day I trust AMT will be zero, in the event that Congress can raise the pay trap.

I see the yearly expense discount as a characterized pool of cash that ought to be shrewdly spent on others as well as yourself. Assuming that you toss the discount into your pool of speculations, its adequacy vanishes. You won’t have the option to feel the delight of a 10% return. However, assuming you contribute the discount on connections, a superior life is standing by.